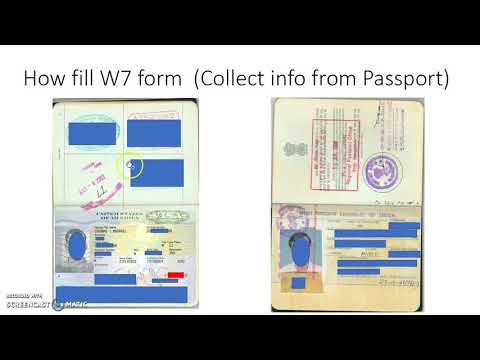

Hello everyone, my name is Deepak Shahu. I'm the founder and CEO of Taxpayers. Today, I'm going to talk about the ITIN application. An ITIN, or Individual Taxpayer Identification Number, is required whenever you want to file your tax or whenever an entity like a bank or a brokerage firm needs to report taxes for you. There are different forms of tax identification numbers, but only a few individuals who have work authorization, like those in H-1B, L2, or H4 with EAD, can apply for a Social Security Number (SSN). For others, including dependents, they need to apply for an ITIN. Here are the examples of who can apply for an ITIN: spouses of primary individuals, their dependents who are residents, and foreign individuals selling property or having bank interest. The documents required would be the completed tax return with supporting documents, the W2, and the applicant's name should be present in the tax return as a spouse, taxpayer, or dependent. You also need to have the completed W7 form and either your original passport or two documents establishing identity and foreign nationality. You can apply for an ITIN at IRS offices, certifying acceptance agents, or by mailing your documents to the IRS. If mailing, you need to include your original passport or original documents. To start, you need to collect information from your passport, including the main page, the visa page, and the stamp bridge. Next, you will start filling out the W7 form. Make sure to download the latest version from the IRS website. If you are applying for a new ITIN, check the corresponding on the form. If you are renewing an existing ITIN, check the second option. There is a list of common reasons why you're applying for an ITIN, such as being a spouse of...

Award-winning PDF software

w7 Form: What You Should Know

Form W-7. (Rev. August 2019) — IRS Form W-7. (Rev. August 2019). Department of the Treasury. Internal Revenue Service. Application for IRS Individual Taxpayer Identification Number. Who should receive your Form W-7 Form W-7. (Rev. August 2019) — IRS What it says: An ITIN or individual taxpayer identification number (“ITIN”), is a tax identification number assigned by the Internal Revenue Service for individuals that who are not U.S. citizens. For information about the ITIN procedures, please refer to IRS Publication 505, Tax Guide for U.S. Citizens and Aliens (IRS Publication 505). Who should receive Form W-7: Application for IRS Individual Taxpayer Aug 16, 2025 — A W-7 Form is used to apply for an individual taxpayer identification number, or ITIN, for non-citizens who aren't eligible to receive a Form W-7 (Rev. August 2019) — IRS How to Apply for a Form W-7 (Rev. August 2019) — IRS Use Form W-7 (Rev. August 2019) — IRS What is Form W-7? Form “W-7” is the name for your application to start a new process for obtaining a tax identification number (ITIN) for U.S. citizens, or who are not U.S. citizens, who: Are U.S. citizens, non-U.S. citizens, or foreign residents; Are not enrolled in a FAFSA form; Have outstanding income that exceeds the IRS's current income limits; and Are not eligible for a Social Security Numbers (SSNs). The information on this page is only a general description. Form W-7 is a new IRS procedure August 2025 — A W-7 Form is used to apply for an individual tax identification number, or ITIN, for non-citizens who aren't eligible to receive a Form W-7 (Rev. August 2019) — IRS Is an individual taxpayer identification number (ITIN)? The IRS determines whether an individual who meets one of the criteria in the Form W-7 or is eligible to receive an SSN qualifies for an ITIN. Individuals who meet the criteria will be deemed to meet the ITIN requirements.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Cp565, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Cp565 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Cp565 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Cp565 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form w7