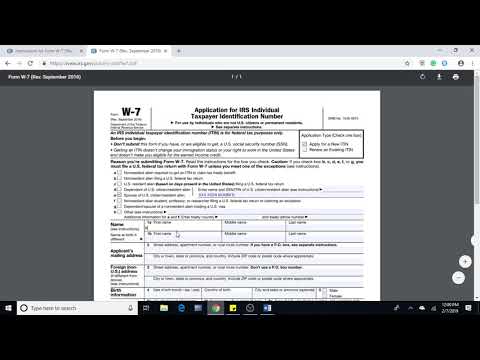

Hello everyone, I hope all are doing great today. Let's discuss the ITIN application process. ITIN is an individual taxpayer identification number, issued by the IRS to individuals who are not eligible for a social security number (SSN). People who file withholding tax returns, such as non-working spouses and dependents, can apply for an ITIN. Now, let's talk about an H-4 visa holder. If the spouse of an H-1B visa holder is an H-4 visa holder, he or she can be eligible to apply for an ITIN. This is a basic introduction to ITIN, so let's get started. To apply for an ITIN, make sure to download Form W-7 from the official IRS website (IRS.gov). This form is specifically for obtaining an individual taxpayer identification number. Check if the form is the most recent version, typically labeled as September 2016. Next, let's go through the mandatory sections in the application process. If you are a new ITIN applicant, refer to sections C, D, and E to determine your eligibility. Spouses of US citizens or lawful permanent residents (green card holders) can check section C. H-4 visa holders can check section D if they are a dependent of an H-1B visa holder. Moving on to the next section, you need to fill in the name of the H-1B visa holder and provide member details. Enter the name of the applicant who is applying for the ITIN and make sure it matches the name on their passport. If there is a different name at birth, enter it in the appropriate field. Include the first name, middle name (if applicable), and last name. One important thing to note is that the ITIN membership information will be sent to your mailing address, even if you are not currently residing in the United States. Therefore, provide a valid United...

Award-winning PDF software

Cp565 Form: What You Should Know

To get a CP 565 you need to send it to the Taxpayer Information Service (TIS). The TIS will then email or mail you instructions for filling out the form and filing it. You must sign it. Who is eligible for the CP 565? You must not have to file a tax return for this year and the prior four years. You are the following. a. A resident of the United States of America (a “residents of the U.S.” means a United States citizen or resident of the U.S. who: (1) Is physically present in any of the 50 United States, the District of Columbia, Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands or the Commonwealth of the Northern Mariana Islands for at least 183 days in the tax year; and (2) Is not eligible for the Earned Income Tax Credit (ETC) or the refundable portion of the Additional Child Tax Credit (ACT). If you qualify for the ETC, you have to claim it separately. In order to receive the ETC, you must not be claimed as a dependent on a taxpayer's tax return or claimed more than one credit on Form 1040, 1040A, 1040EZ, or 1040A. You are exempt from tax if: You pay personal income tax because of a marriage or civil union, or a parent-child relationship. (But see the note below regarding spouses.) You filed your last tax return before the ETC was waived. You are married or a divorced spouse who is the sole or primary care provider for a dependent who is in the custody or control of a child, or an adult dependent who is in the custody or control of an adult child. b. A domestic partner of U.S. citizen or protected person. c. A dependent of a domestic partner. d. An individual married to a U.S. citizen (this exemption will end on January 1, 2026). You must claim this exemption if your gross income would be more than the taxable amount shown in box 1 of your Form 1040, line 21 of Form 1040X or line 7 of Form 1040A. e. The spouse of a child who is described in box 5 of a line 14 of Form 1040 (other than a qualified spouse exemption holder whose child was a U.S.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Cp565, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Cp565 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Cp565 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Cp565 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form Cp565